When CBN 🏦 Zigs, Innovators🧑💻 Have To Zag

If my Naira debit card 💳can no longer process International transactions what is a solution 🤔?

Hello Innovator!

A few months ago the CBN (Central Bank of Nigeria) stopped Naira debit cards from processing International transactions, allegedly in the best interest of the Naira currency. Citizens have since turned to alternatives to perform their international transactional needs, and it’s been 4 months.

It’s no news that this decision by CBN put banked Nigerians in quite a pickle. People don’t talk enough about what a burden trying to find a solution was, in the first few days and weeks after the change. I guess it’s true what they say '“Nigerians adapt quickly in any situation” We never realized how much we relied on the Naira Visa and Mastercard debit cards until recent times.

As innovators let’s examine what has changed since the Naira debit cards stopped supporting international transactions.

But first, let’s have a good laugh from tech Twitter.

And one from the streets 😂

Okay👌, now let’s get into it

Of course, the natural solution suggested after the ban on the Naira debit cards was the domiciliary account, so let’s weigh its pros and cons. Did it help in solving the problem or is it an unattainable fit in “solutions” clothing?

Domiciliary Accounts

International currency accounts are no newbies to the banking industry since it is good for citizens who need to be reputably banked in foreign seas. Moreover, it's not new in a country like Nigeria, with thousands of its workforce migrating for greener pastures.

There is no question that "domiciliary accounts” are synonymous with “life savers”.

However, how does this help a Nigerian AliExpress shopaholic?

A requirement in opening a dom account (as it is fondly called) is a $100 note. This is not the legal tender in Nigeria and might pose a challenge.

However, a typical Nigerian knows the Aboki route, but does that solve it? if you can get it once how about funding it for future purposes? A dom account holder should have a method through which they intend to fund their account. There are two options, namely money transfers (salary or money from relatives) to the dom account or depositing dollar bills at the counter.

A domiciliary account might not help every locally operating Nigerian much. A solution in which banked Nigerians can fund an international account through their local bank transfers is needed too. This should be something that conveniently offers the service of converting one currency to the other.

International Fintechs vs. Local Fintechs

Innovative Fintech all the way 💃💃. This is where innovators begin to zag. While some are zagging quite alright, you’ll find that some can do better.

A search for solutions puts the Fintech industry in the spotlight and without question spikes some comparisons between local and international fintech.

It is a known fact that Nigerians are subject to a lot of limitations internationally, a famous example is Paypal. However, this doesn’t mean that Nigerians are helpless where International fintech is concerned, some still give a fair chance.

Since Naira debit cards have a limitation, virtual USD cards are instinctively a solution. We’ll delve into a few examples of some local and international fintech and the virtual USD card services they provide.

International Fintechs

Payoneer

Payoneer is a well-known fintech company. It offers reliable services and has a good number of reviews to prove it.

It also offers reliable virtual card services with a condition to start with. You must have received a minimum of 2000 USD in the past 6 months to be able to request a card.

Do you like it? Seems fair enough. You are good to go.

Wise (Formerly Transferwise)

This has to be a favorite in terms of the exchange rate in sending out money. It seems you can send out more with Wise.

The exchange rate for Naira to a dollar is N410 to $1, but they warn you that the exchange rate is not guaranteed.

What? Not guaranteed? Yes, Apparently.

The virtual cards are also quite reputable except if you live in Nigeria.

When you click the “card” section you get a reasonable response.

“Sorry, our cards aren't available in Nigeria yet. We are hardly perfect, it's on us to correct this, and you'll be the first to know when we do."

The innovators from Wise should zag for Nigerians a little bit more.

Local Fintechs

Chipper Cash

African fintech comes to the rescue with these limitations. The local fintech seems to understand the assignments a lot more🤷. It seems that when CBN started to zig, African Innovative fintech said “hold my beer” and they have been zagging ever since.

International transactions are also smooth with the Chipper cash Virtual USD cards. The virtual USD cards are funded from the user’s chipper cash wallets.

The card creation and card maintenance fees are major factors to be considered when choosing a virtual dollar card service in Nigeria. Chipper Cash charges $1 to create a card and $2 to maintain it.

With the ever-increasing good reviews, the rates are also quite competitive.

Payday

This seems to be the Fintech on the lips of almost every individual who has business with international transactions. Payday creates and maintains cards for $0 to the user, this is definitely a game changer as opposed to the normal $1 and $2 fees in the industry.

With reviews building up by the second, the Payday virtual USD card seems to cover a wide range of international ground.

Users seem to understand the exchange rate though others might think it is outrageous.

$1 = N748 (Top-up) & $1= N734 (Payout). This is the operating range of payday.

CBN Plays Superhero🦸 and attempts to "Save The Day” With AfriGo

It seems that in only a matter of months, CBN is trying to be both the villain and the hero in a story.

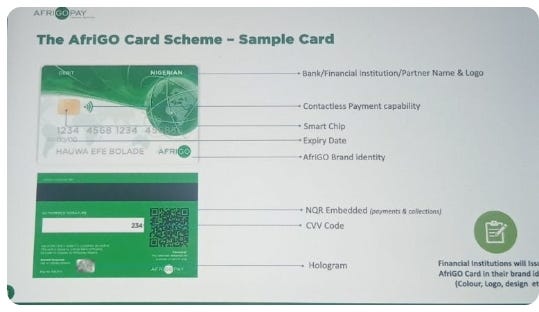

The launch of the Visa and Mastercard competitor AfriGo has been met with both praise and criticism.

AfriGo is a domestic card scheme that is set to offer some exclusive advantages. These advantages are what would make it different from other card service providers.

The plan with AfriGo is to promote financial inclusion, reduce operating costs for financial institutions, and data sovereignty among others.

Would the AfriGo cards be able to perform International transactions?

That's something I'm not sure of because domestic card schemes only work within a country but some articles I've read seem to say otherwise.

Share With A Friend

Connect with Consonance’s vision of inspiring innovation by sharing this newsletter with friends.

By inspiring friends to build upon their innovative ideas, you contribute to a better Africa and a better world at large.

You can share this newsletter on your WhatsApp status or even post it on Twitter.

Make a difference today!

Notable Reads For The Week

The central bank of Nigeria extends the deadline for swapping old notes to February 10, 2023

The central bank of Kenya approves 12 more digital money lenders

Opportunities

Klasha has a couple of open positions in Lagos, Nigeria

Flutterwave is hiring a User Policy Strategy

Big Cabal Media has two open positions